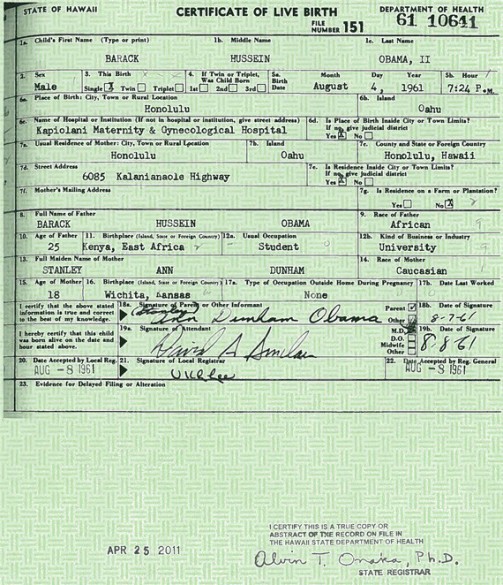

So in addition to the problems already pointed out, it apparently appears that there are blatant photoshop fingerprints on the birth certificate released yesterday. Considering the vast amount of monetary and manpower resources at the Obama Administration’s disposal, I can only believe that the poor quality of the birth certificate was done deliberately.

- The Obama Administration knew that, on the one hand, even if they released a birth certificate written in crayon the mainstream media would hail it as the real thing; and on the other, even if they released a perfect copy most of the “Birthers” still wouldn’t believe it. I certainly wouldn’t. So by releasing a plausible but riddled with errors birth certificate Obama ensures that his opponents on the birth certificate question stay in place while at the same time giving the MSM some more ammunition to hammer them as “crazy” all during the 2012 Presidential race, thus strengthening his reelection campaign.

- By releasing the birth certificate, the Obama Administration has deftly focused all the debate on the fairly irrelevant question of the birth certificate itself and where he was born rather than the truly important question of his father’s citizenship status and the “natural born citizen” definition.

- Yesterday was also the first time in its entire history that the Federal Reserve held a press conference. Since the Federal Reserve is the main enabler of the Federal Government’s tyranny, having the public caring about what the Federal Reserve is up to is a hundred times more important than whether or not Mr. Obama is eligible for the presidency. The timing of the release of the birth certificate was neatly designed to suck the public’s attention away from the Federal Reserve which would have been the main story yesterday if not for the release.

And so, to try to do my part to prevent #3 from succeeding, here’s some stuff on the Federal Reserve’s press conference yesterday:

Rep. Ron Paul on the press conference:

Chairman Bernanke’s press conference today was unprecedented, and it demonstrates that Federal Reserve officials are very concerned about growing public criticism of Fed policies. Although Mr. Bernanke predictably provided no substantive information, the American people want real answers about Fed bailouts, lending to foreign banks, and most of all inflation. Mr. Bernanke continues to ignore his culpability for the inflation all Americans suffer due to the Fed’s relentless monetary expansion. Rising prices are the direct result of Fed devaluation of our dollar. Yet rather than addressing the Fed’s loose dollar policy, Mr. Bernanke continues to assure us that inflation is not a problem.Without the Federal Reserve’s relentless expansion of credit throughout the 1990s and early 2000s, there could have been no excessive borrowing or explosion of subprime lending. Through easy credit, the Fed initiated the economic boom that created the dot-com bubble. When that bubble burst the Fed pumped additional liquidity into the system, which led to a new boom that created the housing bubble. Commodity prices have risen rapidly, producer prices have followed suit and consumers are already seeing the beginning of massive price increases passed on to them. And now the Fed’s additional trillions of dollars in monetary pumping is creating yet another bubble. This is the exact opposite of stability in the marketplace and has nothing to do with free markets. It is central economic planning at its worst. And the end result may be hyperinflation and the destruction of our currency.

Now Americans are waking up to the dangers of the Fed’s inflationary monetary policy, and they want it to stop. Today’s staged press conference will not be enough to stop the growing demand for real Fed transparency, and I hope to build on that grassroots demand by passing legislation that will result in a true audit of the Fed’s activities.

Support from my colleagues was vital in the last Congress in making progress towards Fed transparency, and I hope to build on that support in this Congress. It is well past time that we begin to rein in the Fed.

Gerald Celente on Russia Today discussing the press conference:

| Tweet |

|

|

|