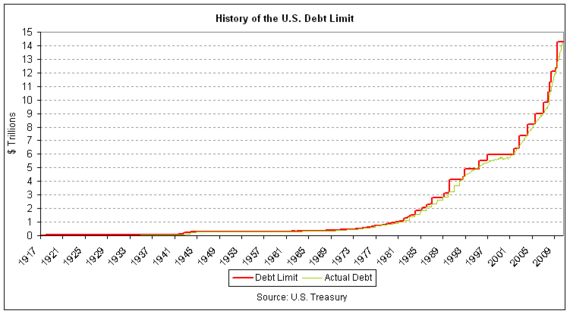

Today (May 16, 2011) the United States has hit the public debt ceiling once again. The debt ceiling is the statutory limit on federal debt set by the U.S. Congress, capping how much public debt the U.S. Treasury (usually via the Federal Reserve) can incur.1 The debt ceiling was established in 1917 by the Second Liberty Bond Act and the issuing of $11.5 billion in bonds ($193.2 billion in today’s dollars).2 The last increase of the debt ceiling occurred on February 12, 2010 and increased the ceiling to $14.92 trillion (that’s $14,920,000,000,000) – seventy-seven times the original ceiling, using the inflation-adjusted amount. You can see by the above graph that the amount of these increases, both absolutely and in terms of magnitude, is growing at an exponentially increasing rate.3

This morning, U.S. Treasury Secretary Timothy Geithner issued the following letter:4

The Honorable Harry Reid

Democratic Leader

United States Senate

Washington, DC 20510Dear Mr. Leader:

I am writing to notify you, as required under 5 U.S.C. § 8348(l)(2), of my determination that, by reason of the statutory debt limit, I will be unable to invest fully the portion of the Civil Service Retirement and Disability Fund (“CSRDF”) not immediately required to pay beneficiaries. For purposes of this statute, I have determined that a “debt issuance suspension period” will begin today, May 16, 2011, and last until August 2, 2011, when the Department of the Treasury projects that the borrowing authority of the United States will be exhausted. During this “debt issuance suspension period,” the Treasury Department will suspend additional investments of amounts credited to, and redeem a portion of the investments held by, the CSRDF, as authorized by law.

In addition, I am notifying you, as required under 5 U.S.C. § 8438(h)(2), of my determination that, by reason of the statutory debt limit, I will be unable to invest fully the Government Securities Investment Fund (“G Fund”) of the Federal Employees’ Retirement System in interest-bearing securities of the United States, beginning today, May 16, 2011. The statute governing G Fund investments expressly authorizes the Secretary of the Treasury to suspend investment of the G Fund to avoid breaching the statutory debt limit.

Each of these actions has been taken in the past by my predecessors during previous debt limit impasses. By law, the CSRDF and G Funds will be made whole once the debt limit is increased. Federal retirees and employees will be unaffected by these actions.

I have written to Congress on previous occasions regarding the importance of timely action to increase the debt limit in order to protect the full faith and credit of the United States and avoid catastrophic economic consequences for citizens. I again urge Congress to act to increase the statutory debt limit as soon as possible.

Sincerely,

Timothy F. Geithner

In other words, because the U.S. government is running a huge deficit, it must borrow money to be able to cover all its spending. However, the treasury has hit the limit on the amount of money it can borrow and is thus in danger of beginning to default on its debts and of being unable to cover its spending obligations, because the clock is still ticking. The treasury thus wants Congress to raise the debt ceiling once again, so that it can resume borrowing and dig the U.S. government even further into the financial hole – although it is technically Congress’s fault, as they set the budget and both parties just love their big government spending (see here, here, and here). But that’s all old news. What’s really interesting about this announcement is that Secretary Geithner is dipping into pension funds to keep the government afloat for a little while longer.

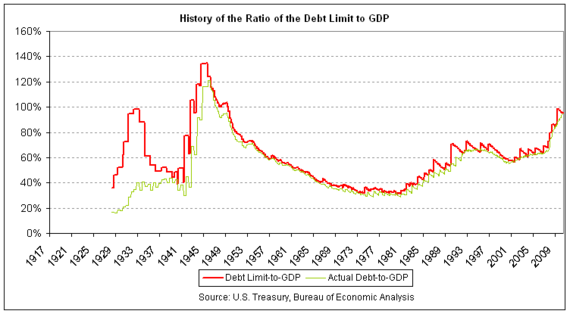

Why can’t we just go on raising the debt ceiling indefinitely? Because of this chart showing the ratio of U.S. debt to U.S. GDP since 1929:5

This debt-to-GDP ratio is analogous to radiation poisoning. I generally think that public debt is a bad idea, but at small or medium levels it is usually manageable. But once you hit high levels, major and often irrevocable damage is done, even if the effects are not seen or felt right away. This analogy is explained in more detail here:

Once the 80% debt to GDP level is exceeded, the point of no return is reached without severe and immediate treatment. If the debt is not addressed and continues to increase, the economic health effects can be felt sooner and more severely as we see in the example of Greece. . . .

Recall that both Iceland and Ireland had relatively low debt levels back in 2006 (around 50% of GDP) but bank bailouts and associated “stimulus” measures quickly drove the debt toward 100% of GDP. Iceland wisely let the banks fail and the economy is gradually recovering, but Ireland determined to prevent bondholders from taking a haircut and now is looking at another massive bank bailout.

Note that he points to an 80% debt-to-GDP ratio as the tipping point, and that the U.S. currently stands at a 97% debt-to-GDP ratio ($14.3 trillion debt to $14.7 trillion GDP).6 Iceland was indeed wise to let its bank fail and to refuse to use public funds to pay for private losses, while on the other hand, Ireland is now raiding private pensions to stay afloat – just a step further down the road compared to what, according to Secretary Geithner, the U.S. government is currently doing to public pensions.

Some will say, “But wait – Geithner said that this has happened before with the pensions, and those funds were replaced. Plus, I see on that chart that the U.S. almost hit a 120% debt-to-GDP ratio just after WWII in 1949, and we recovered just fine from that, didn’t we?”

The answer is that the current situation is very different from the one in 1949, with none of the developments being positive.

- In 1949, federal spending was 14% of U.S. GDP. In 2011, federal spending is 25% of U.S. GDP.7

- In 1949, the U.S. dollar was just beginning its reign as the world’s reserve currency. In 2011, the U.S. dollar is quickly losing its place as reserve currency.8

- In 1949, the U.S. GDP was exploding in post-WWII growth. In 2011, the U.S. GDP is stagnating, and we will be overtaken by China as the world’s most powerful economy within five years.

- In 1949, the U.S. debt was being fueled by a war that had just ended. In 2011, the U.S. debt is being fueled by social security, Medicare, and other domestic welfare that will only increase as the population ages.9

- In 1949, the U.S. was a racially and culturally homogeneous Christian nation. In 2011, the U.S. is a racially and culturally balkanized Marxist country.

In short, the radiation poisoning is setting in, and we are in very bad shape. We are headed off a financial cliff at breakneck speed, and I believe that things may already have gone too far for us to be able to stop in time. However, if a collapse is to be averted, then we must take drastic measures immediately. A good start would be to begin lowering the debt ceiling, not increasing it. Would this be painful for the economy? Yes, it would, yet not as painful as the full collapse we can otherwise expect; the longer we wait to slam on the brakes, the more painful it will be in the long-run.

Recently, the Republicans miserably failed to halt the increase in U.S. spending and the U.S. deficit, but if they now simply refuse to increase the debt ceiling any further, then they can impose a de facto balanced budget on the U.S. government, since if the treasury cannot borrow any more, then it can only spend what it receives in revenues. It would be a gutsy move, and the Republicans will take flak for it, but in the long run it is the best move they can make for the country. Unfortunately, my money is on the Republican eunuchs folding like wet paper towels and the debt ceiling getting increased again. Full steam ahead for the USS Financial Collapse.

Footnotes

- http://en.wikipedia.org/wiki/United_States_public_debt#Debt_ceiling ↩

- http://www.theatlantic.com/business/archive/2011/04/the-us-debt-ceiling-a-historical-look/238061/ ↩

- http://www.reuters.com/article/2010/02/12/us-usa-obama-debt-sign-idUSTRE61B4AU20100212 ↩

- http://www.zerohedge.com/article/treasury-confirms-debt-ceiling-be-breached-today-will-tap-pension-funds ↩

- http://www.theatlantic.com/business/archive/2011/04/the-us-debt-ceiling-a-historical-look/238061/ ↩

- http://www.usdebtclock.org/ ↩

- http://www.data360.org/dsg.aspx?Data_Set_Group_Id=230&count=all ↩

- http://blogs.forbes.com/afontevecchia/2011/03/16/central-banks-dump-treasuries-as-dollars-reserve-currency-status-fades/ ↩

- http://zbigniewmazurak.wordpress.com/2010/06/26/welfare-spending-is-the-largest-item-in-the-federal-budget/ ↩

| Tweet |

|

|

|